Form 15g In Word Format

Quick steps to complete and e-sign Form 15g Download In Word Format For Pf Withdrawal online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Get the free form 15g download in word format. 15G See section 197A (1), 197A (1A) and rule 29C Declaration under section 197A (1) and section 197A (1A) of the Income tax Act, 1961 to be made by an Individual or a person (not being a company. Form 15G and form 15H has to be submitted at each branch where you have deposits i.e. If you have 5 deposits in different branches then you need to submit 5 form 15G or form 15H for such deposits. There can be instances where after submitting form 15G or 15H, the bank has deducted TDS out of your income.

Form 15G is a declaration to ensure that no TDS has deducted from the income and it can be submitted by individuals of India whose age is below 60 yrs.

We need to submit this form 15G to banks whenever we are getting an interest amount of above 40,000 Rs from the FDs and also for PF withdrawals if the total PF claim amount is more than 50,000 Rs and service is below 5 years.

If you are looking for Form 15G in Word format then you can download below form 15G in Word format.

Can I fill 15G form online

Some major public sector banks and private banks are providing an option to submit form 15G online for fixed deposits. For that you need to login in your bank’s internet banking website there you can see an option to submit form 15G.

Example : in SBI Internet Banking

The best thing of filling form 15G online is there is no need to write every detail manually, all your details will be selected automatically you just need to select the financial years only.

Difference between Form 15G & 15H

Form 15G is for the individuals whose age is below 60 years and form 15H is for the individual whose age is above 60 years. Both are to ensure that no TDS is deducted from the incomes of the individuals.

What is form 15G for PF withdrawal

EPF members need to submit form 15G whenever the PF claim amount is more than 50,000 Rs but their total service is below 5 years, in remaining cases there is no need to submit form 15G.

To submit form 15G online, the PAN of the EPF members must be linked with their PF account.

What happens if form 15G is not submitted

If you don’t submit form 15G even though you are eligible then TDS will be deducted unnecessarily from your interest income or PF claim amount. In some cases EPFO will reject your PF withdrawal application if you don’t submit form 15G.

What is estimated income on form 15G

Estimated income on form 15G means the amount for which you are submitting it. For example if you are submitting form 15G for Fixed Deposits then mention the estimated interest amount for the financial year.

Download Form 15g In Word Format

(Or) If you are submitting form 15G for PF withdrawal then mention your PF claim amount and you don’t need to include pension amount in form 15G.

Also Read

What is EPF Form 15G? In the financial year of 2016-17, the officials of EPFO had issued a notice stating that Tax Deducted at Source (TDS) is applicable on EPF withdrawal above Rs.50,000. Thus any employee who wishes to withdraw PF money above 50,000 will have to pay the TDS charges. So if any individual’s EPF withdrawal limit is more than 50,000 and PAN Card is not verified at the EPF portal, then he/she can simply submit Form 15G/15H to the EPF officials requesting them not to deduct TDS (if applicable) on the PF withdrawal amount.

On this page, we have provided all the details on how to withdraw the EPF amount by submitting Form 15G, along with instructions, documents required, and a detailed procedure on how to submit EPF withdrawal claim form 15G online. Read on to find out more.

Is Form 15G Mandatory For PF Withdrawl Less Than 50,000?

Individuals must note that Form 15G is not applicable if your withdrawal limit is less than 50,000. However, TDS is also not applicable for individuals who wish to withdraw the PF amount under the following scenarios:

Form 15g Download Word

- If an individual is transferring his PF money from one account to another account

- If the employee service is terminated due to health issues

- If business by the employer is discontinued

- If the employee service period is more than 5 years that is there is no TDS on PF withdrawal. Which also includes 5 years of employee service under one or multiple organizations.

When TDS Is Deduceted on PF Withdrawl?

If an employee withdraws 50,000 or more than that, the TDS will be deducted. The TDS charges applicable for the same are as follows:

- If an individual submits PAN Card and doesn’t submit Form 15G/15H, then 10% will be deducted.

- If the individual fails to submit the PAN Card, then TDS will be deducted at maximum marginal rate i.e, 34.608%.

EPFO Notification On No TDS For EPF Withdrawal

The official EPFO notification on No TDS deduction for EPF Withdrawal are given below:

How To Submit Form 15G Online For EPF Withdrawal?

Many of the EPF members fail to get verify their PAN Numbers digitally in the EPFO portal because of personal details mismatch in UAN & PAN Card. And this is the main reason, the EPFO officials will impose TDS in EPF withdrawals. So one of the best ways to run off the TDS is by submitting Form 15G.

How To Get Form 15G Online For PF Withdrawl?

The direct link to download Form 15G is given below:

You can either download EPF Form 15G ODF from the above link or also can check the procedure to download the same from the official website.

The steps to download 15G Form Online for PF withdrawal are listed below:

- Visit the official website of UAN Member Website: Click Here

- Now login with the help of your UAN Number & UAN Password.

- In the UAN dashboard, move to the Online Services tab.

- Now select Claim (Form 31, 19, 10C) from the drop-down menu.

- Verify your last 4 digits of your bank account number.

- EPF withdrawal form will be displayed on the screen. Below the EPF withdrawal form, the user will be able to “Upload Form 15G”.

- Click on it and From 15G will be downloaded to your device.

- Two pages namely Part I & Part II will be there where you will have to fill out the details.

Form 15G Download In Word Format

Many individuals will search for Form 15G in Word format since it makes one’s work easier. However, there is no option for individuals to download Form 15G in word format since the officials will give them only in PDF format. So individuals looking for Form 15G download link in Word format for PF withdrawal can follow the steps as listed below to get the same:

- Download Form 15G in PDF format.

- Now search “PDF to Word Conversion” in Google or search engine.

- Upload the PDF to any of the third-party websites and click on Convert.

- As soon as you click on Convert, the Form 15G PDF will be converted to Word Format which can be downloaded for free.

How To Fill Form 15G For PF Withdrawal?

As discussed above, there are 2 pages Part I and Part II in Form 15G. Only Part I needs to be filled by the individuals. The steps to fill Form 15G filed wise are given below:

- Field 1 – Name: Enter your name as per your PAN Card

- Field 2 – PAN: Enter your PAN number

- Field 3 – Status: Mark your status such as Individual, HUF, or AOP as applicable for you.

- Field 4 – Previous Year: Refers to the current financial year you are filling the form. For example, if you are filling for 1st April 2020 to 31st March 2021, then enter 2020-21.

- Field 5 – Residential Status: Enter your nationality. Mostly Indian.

- Field 6 to 12 – Address Details: Enter your current address details.

- Field 13 – Emai ID: Enter your valid email ID.

- Field 14 – Telephone Number: Enter your mobile number, If the landline is available enter your landline number with the STD code.

- Field 15 (a) – Whether assessed to tax under the Income-tax Act,1961: Mention Yes or No.

- Field 15 (b): If Yes, the Latest Assessment Year Which Assessed: If you have marked yes in Field 15 a, then mention the last filed ITR financial year.

- Field 16 – Estimated Income for which this declaration is made: Calculate your total income which you have earned during the financial year excluding EPS or Pension.

- Field 17 –the Estimated total income of the P.Y. in which income mentioned in column 16 to be included: Mention the total income along with EPF withdrawal amount.

- Field 18 –Details of Form No. 15G other than this form filed during the previous year, if any: If you have filled Form 15G previously then mention those details.

- Field 19 – Field 19. Details of income for which the declaration is filed: Mention the nature and amount of income here.

Sample Filled Form 15G For PF Withdrawal

The sample filled Form 15G is given below:

How To Upload Form 15G for PF Withdrawl?

The steps to upload Form 15G in the portal are given below:

- After filling out Form 15G, convert it to PDF format.

- Make sure your Form 15G is less than 1 MB.

- Now login to the UAN website with the help of your credentials.

- Click on the “Online Services” tab and select Claim Form 31, 19, 10C.

- Now choose Form 19 from the dropdown menu.

- Click on Choose File and Upload the PDF.

Form 15g In Word Format For Ay 2020-21 Download

Difference between Form 15G and 15H

The main difference between form 15G and 15H is that the 15H form is applicable for senior citizens only. Because the interest rates differ from individuals to senior citizens, Form 15H can be submitted by senior citizens whose is eligible for TDS but also 60 years old.

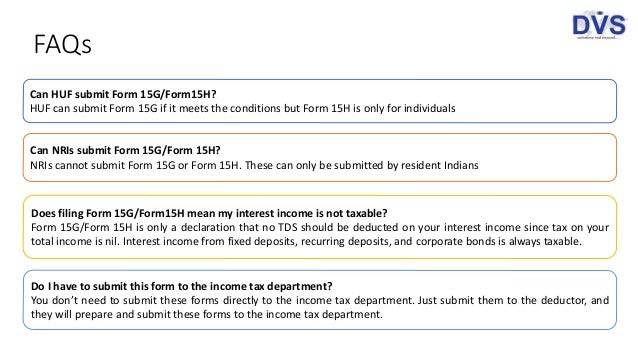

FAQs on Form 15G

The frequently asked questions on Form 15G are given below:

Q. Is 15G form required for PF withdrawal?

A.Yes, if you are an individual below 60 years and want to withdraw more than 50,000 then Form 15G can be submitted.

Q. How can I download Form 15G for PF?

A.You can either download From 15G from this page or also from the officials EPFO Portal under ONLINE SERVICES >> Claim (Form 31, 19, 10C).

Form 15g In Word Format For Ay 2022-23 Download

Q. What happens if 15G not submitted?

A.If form 15G is not submitted then TDS charges will apply for your PF withdrawal amount.

Now that you are provided all the necessary information on Form 15G and we hope this article is helpful to you. If you have any questions ping us through the comment box below and we will get back to you as soon as possible.